Foreign digital service providers (DSPs) operating in the Philippines have until May 16, 2025, to comply with a new law imposing a 12% VAT on overseas digital services, including streaming platforms, online marketplaces, and cloud services.

The Bureau of Internal Revenue (BIR) has set up a VAT on Digital Services (VDS) portal for DSPs to register and meet administrative requirements, with penalties including site closures and sanctions for non-compliance.

The law applies to both business-to-business and business-to-consumer transactions, and the BIR will coordinate with the Department of Information and Communications Technology (DICT) to monitor compliance.

While major DSPs like Netflix and Google have not yet commented, the BIR has actively informed companies about the law’s requirements.

The law is expected to generate significant revenue for the Philippine government, though some critics express concerns about the impact on prices and the efficiency of tax administration.

Source: PhilNews24 | January 19, 2025

Latest from Business

The Philippines aims to boost its geothermal energy production as part of efforts to increase the

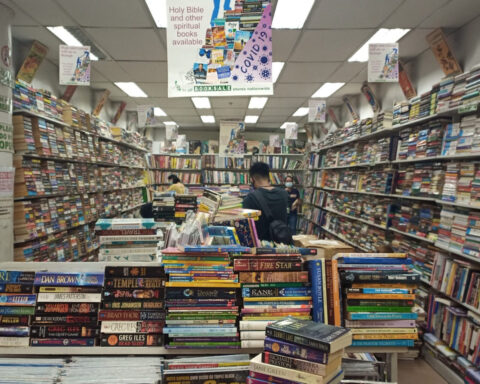

Filipino preloved book sellers, such as Booksale Philippines and Bookchigo Trading, are adapting to global trade

Consumers can expect prices of necessities and prime commodities (BNPCs) to remain stable until the end

World leaders convened in Malaysia on Monday to discuss strategies for strengthening economic and trade ties

VITRO Inc., the data center arm of the PLDT Group, has graduated the first batch of